Petty Cash vs. Cash Drawer vs. Making Change (and Starting Cash Drawer Balance)

In this post we’re going to talk briefly about the differences between Petty Cash and the Cash Drawer since there seems to be some confusion about the two. We will also take a look at your Starting Till Balance and How to Make Change with Separate Monies.

Petty Cash

Petty Cash is a special module built into Lizzy to help you keep track of miscellaneous cash purchases. Usually a company that maintains a petty cash account will do so in a separate drawer or box in order to keep track of the funds. If you happen to be using your cash drawer as your petty cash drawer, we’d recommend you stop and use a separate area instead. Using your cash drawer to hold petty cash isn’t the best way to keep track of your petty cash funds and can cause more problems than it’s worth.

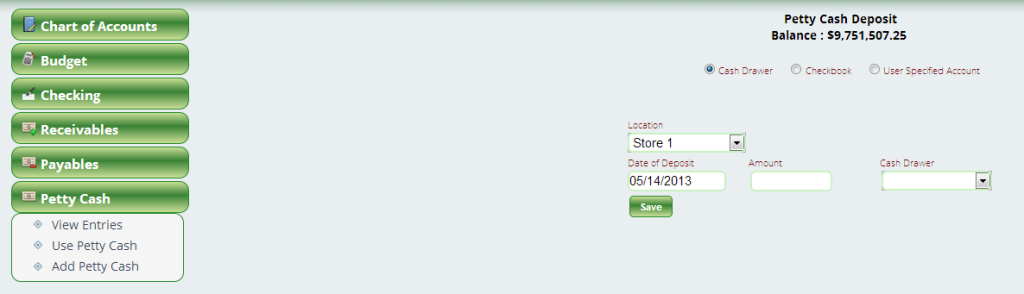

When you are working with Petty Cash, you want to do so through the module itself. To put money in, you Add to Petty Cash – and you have the following options to choose where you are pulling the money from:

- Cash Drawer

- Checking Account

- General Ledger Withdrawals

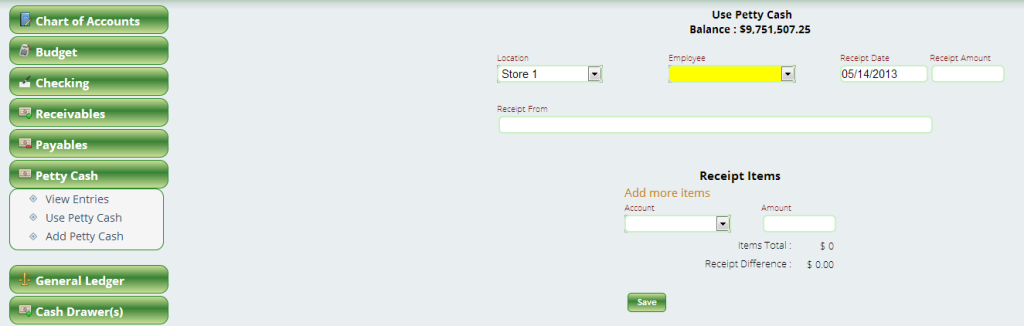

The Petty Cash module allows you to see where the funds are going by itemizing expenses. Even on a single receipt you might have items purchased together that don’t fall into the same accounting category. Lizzy allows you to keep track of exactly what was spent and for what purpose.

By using the Petty Cash module, you allow the system to keep up with how much you have in your petty cash account and what it is being used for throughout the year.

Cash Drawer

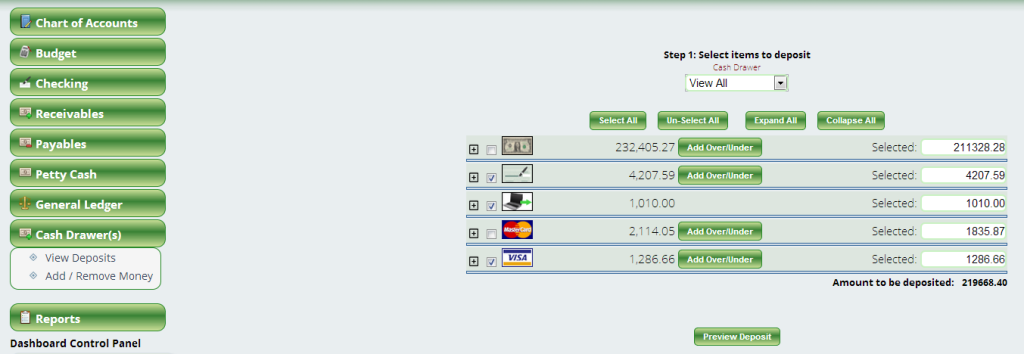

The Cash Drawer is a holding tank. This holding tank is where all the cash, checks and credit cards are held until you tell Lizzy you are moving these to the checkbook. The funds come from Invoice payments and Receivable payments.

From the Cash Drawer module you can also perform over and unders. This might be done because there is missing cash or it could be that your credit card processor takes their fees out prior to depositing the money in your account and you need to adjust for this. (We’d highly recommend changing credit card processors if this is the case.)

Starting Balance in Cash Drawer

This has nothing to do with the balance that is currently in the Cash Drawer, but instead allows you to track how much money you start out with each day. To record this balance, create a cash account in the Chart of Accounts. You will need to do a General Ledger adjustment to get the balance in the account. Now, if you change that starting balance – and the bank deposit you are doing is going to cause that effect, then you do an Add/Remove money in the Cash Drawer and use this cash account as the offset. If you are taking money out of the starting balance and you are just going to go and take it to the bank, do a New Deposit in the checking section and use that cash account as the offset.

Keeping Track of Money for the Purpose of Making Change for Your Cash Drawer

This is done via the General Ledger (GL). You create a cash account and put a balance in there (either via a GL adjustment, writing a check, or shorting a deposit and hitting this cash account). When you need to make change, you simply change out the money. However, if you need to alter the change, you can do it via the checkbook, the cash drawer or a GL adjustment.